| Bitcoin (source: Wikipedia) | |

|---|---|

Logo of the bitcoin reference client

|

|

| Administration | decentralized[note 1] |

| Date of introduction | 3 January 2009digit |

| User(s) | worldwide |

| Supply growth | 25 bitcoins per block (approximately every ten minutes) until mid 2016,[2]and then afterwards 12.5 bitcoins per block for 4 years until next halving. This halving continues until 2110-2140 when 21 million bitcoins have been issued. |

| Subunit | |

| 10−3 | millibitcoin |

| 10−6 | microbitcoin, bits[3] |

| 10−8 | satoshi[4] |

| Symbol | BTC,[note 2] XBT,[note 3] |

| millibitcoin | mBTC |

| microbitcoin, bits[3] | μBTC |

| Coins | unspent outputs of transactions denominated in any multiple of satoshis[11] |

Bitcoin is a payment system invented by Satoshi Nakamoto in 2008 and introduced as open-source software in 2009. The system is peer-to-peer; all nodes verify transactions in a public distributed ledger called the block chain.[14] The ledger uses its own unit of account, also called bitcoin. The system works without a central repository or single administrator, which has led the US Treasury to categorize it as a decentralizedvirtual currency.[1] While bitcoin is not the first virtual currency, it is often called the first cryptocurrency. This is technically untrue, and while bitcoin is a cryptocurrency, it’s not the first. Instead it’s more correctly known as the first decentralized virtual currency. It is the largest of its kind in terms of total market value.

Bitcoins are created as a reward for payment processing work in which users offer their computing power to verify and record payments into the public ledger. This activity is called mining and is rewarded by transaction fees and newly created bitcoins. Besides mining, bitcoins can be obtained in exchange for fiat money, products, and services. Users can send and receive bitcoins electronically for an optional transaction fee.

Bitcoin as a form of payment for products and services has grown, and merchants have an incentive to accept it because fees are lower than the 2–3% typically imposed by credit card processors. Unlike credit cards, any fees are paid by the purchaser, not the vendor. The European Banking Authority has warned that bitcoin lacks consumer protections. Additionally, bitcoins can be stolen, and chargebacks are impossible. As of July 2013, the commercial use of bitcoin was small compared to its use by speculators, which has contributed to price volatility.

Bitcoins have sometimes been used to purchase illicit items—including child pornography, credit card details, and drugs at dark web black markets. When such sites are shut down, bitcoins have been seized by authorities.

The United States is considered more bitcoin-friendly than some other governments. US law enforcement officials and financial regulators, who had emphasized the role of bitcoin in criminal activities prior, recognized at a November 2013 U.S. Senate hearing on virtual currencies that cryptocurrencies such as bitcoin can provide legitimate financial services to customers. In China, buying bitcoins with yuan is subject to restrictions, and bitcoin exchanges are not allowed to hold bank accounts.

Contents

- 1 Design

- 1.1 The block chain

- 1.2 Units

- 1.3 Ownership

- 1.4 Transactions

- 1.5 Mining

- 1.6 Supply

- 1.7 Wallets

- 1.8 Privacy

- 1.9 Fungibility

- 2 History

- 3 Etymology

- 4 Economics

- 4.1 Classification

- 4.2 Buying and selling

- 4.3 Price and volatility

- 4.4 Speculative bubble dispute

- 4.5 Ponzi scheme dispute

- 4.6 Value forecasts

- 4.7 Reception

- 4.8 Acceptance by merchants

- 4.9 Financial institutions

- 4.10 Mining pools

- 4.11 As investment

- 4.12 Hedge against financial crises

- 4.13 Political economy

- 5 Legal status and regulation

- 5.1 China

- 5.2 European Union

- 5.3 G7

- 5.4 United States

- 6 Criminal activity

- 6.1 Theft

- 6.2 Black markets

- 6.3 Money laundering

- 6.4 Ponzi scheme using bitcoins

- 6.5 Malware

- 7 Security

- 7.1 Unauthorized spending

- 7.2 Double spending

- 7.3 Race attack

- 7.4 History modification

- 7.5 Selfish mining

- 7.6 Deanonymisation of clients

- 8 In the media

- 9 See also

- 10 Notes

- 11 References

- 12 External links

Design

The most important part of the bitcoin system is a public ledger, called the block chain, that records bitcoin transactions. A novel solution is that this is accomplished without the intermediation of any single, central authority, since the maintenance of the ledger is performed by a network of communicating nodes running bitcoin software that anyone can join.[24] Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications. Network nodes can validate these transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes.[11]

The block chain

Bitcoin transactions are recorded in a public ledger called the block chain. The block chain is distributed; to independently verify the chain of ownership of any and every bitcoin amount, each network node stores its own copy of it. Approximately six times per hour, a group of accepted transactions, a block, is added to the block chain, which is quickly published to all nodes. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary to prevent double-spending in an environment with no central authority. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the block chain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.[11]

Units

The unit of account of the bitcoin system is bitcoin. As of 2014, symbols used to represent bitcoin are BTC,[note 2] XBT,[note 3] and ![]() .[note 4][15]:1 Small multiples of bitcoin used as alternative units are millibitcoin (mBTC), microbitcoin (µBTC), and satoshi. Named in homage to bitcoin’s creator, a satoshi is the smallest multiple of bitcoin representing 0.00000001 bitcoin, which is one hundred millionth of a bitcoin.[4] A millibitcoin equals to 0.001 bitcoin, which is one thousandth of bitcoin.[11] One microbitcoin equals to 0.000001 bitcoin, which is one millionth of bitcoin. Microbitcoin is sometimes referred to as simply a bit.[38]

.[note 4][15]:1 Small multiples of bitcoin used as alternative units are millibitcoin (mBTC), microbitcoin (µBTC), and satoshi. Named in homage to bitcoin’s creator, a satoshi is the smallest multiple of bitcoin representing 0.00000001 bitcoin, which is one hundred millionth of a bitcoin.[4] A millibitcoin equals to 0.001 bitcoin, which is one thousandth of bitcoin.[11] One microbitcoin equals to 0.000001 bitcoin, which is one millionth of bitcoin. Microbitcoin is sometimes referred to as simply a bit.[38]

In a press release issued 7 October 2014, the Bitcoin Foundation revealed a formal plan to apply for an ISO 4217 currency code for bitcoin.[5] The press release mentions BTC and XBT as the leading candidates.[39]

Ownership

Simplified chain of ownership.[12] In reality, a transaction can have more than one input and more than one output.

Ownership, in the context of bitcoin, is the ability to spend bitcoins associated with a specific bitcoin address. To do so, a payer must digitally sign the transaction using the corresponding private key. Only a user with knowledge of the private key can sign the transaction and spend bitcoins associated with it. The network verifies the signature using the public key.[11] If the private key is lost, the bitcoin network will not recognize any other evidence of ownership;[24] the coins are then lost and cannot be recovered. For example, in 2013 one user said he lost 7,500 bitcoins, worth $7.5 million at the time, when he discarded a hard drive containing his private key.[40]

Transactions

A transaction must have one or more inputs. For the transaction to be valid, every input must be a digitally signed and previously unspent output of a previous transaction. The use of multiple inputs corresponds to the use of multiple coins in a cash transaction.

A transaction can also have multiple outputs, allowing one to make multiple payments in one go. A transaction output can be specified as an arbitrary multiple of satoshi.

Similarly as in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such case, an additional output is used, returning the change back to the payer.[11]

Mining

Relative mining difficulty[note 8]chart.[note 9] Vertical axis: relative mining difficulty, the scale islogarithmic. Horizontal axis: date ranging from 2009-01-09 to 2014-12-31.

Mining is a record-keeping service.[note 10] Miners keep the block chain consistent, complete, and unalterable by repeatedly verifying and collecting newly broadcast transactions into a new group of transactions called a block.

The new block must contain information that chains it to the previous block and gives the block chain its name. It is a cryptographic hash – bitcoin uses SHA-256 – of the previous block.

Finally, the new block must contain a so-called proof-of-work. The proof-of-work consists of a number called a difficulty target and a number called a nonce, which is jargon for “a number used only once”. Miners have to find such a nonce that gives a hash of the new block smaller than the difficulty target. When the new block is created and distributed to the network, every network node can easily verify the proof.[11] On the other hand, finding the proof requires significant work, since for a secure cryptographic hash there is only one method to find the requisite nonce: miners try different integer values one at a time, e.g., 1, then 2, then 3, and so on until the requisite output is obtained. The fact that the hash of the new block is smaller than the difficulty target serves as a proof that this tedious work has been done, hence the proof-of-work name.

Smaller target numbers reduce the range of accepted nonces, and hence will increase the average time required to find a nonce. The bitcoin system periodically (every 2016 blocks) adjusts the difficulty target so that the average time the entire network needs to find a nonce is about ten minutes. That way, as computer hardware gets faster over the years, the bitcoin protocol will simply adjust the mining target to make mining always last about ten minutes.[11] For example, at the end of April 2014 miners had to try 34.4 quintillion values at average before finding the requisite nonce, while at the end of October 2014 it was 154.6 quintillion values at average.

The proof-of-work system, with the chaining of blocks makes modifications of the block chain extremely hard, as an attacker must modify all subsequent blocks in order for modifications of one block to be accepted. As new blocks are mined all the time, the difficulty of modifying a block increases the higher number of subsequent blocks there are.[43]

Supply

Total bitcoins in circulation.[note 9]Horizontal axis: date ranging from 2009-01-09 to 2014-12-31.

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees.[44] As of 2014, the reward amounts to 25 newly created bitcoins per block added to the block chain. To claim the reward, a special transaction called a coinbase is included with the processed payments.[11] All bitcoins in circulation can be traced back to such coinbase transactions. The bitcoin protocol specifies that the reward for adding a block will be halved approximately every four years. Eventually, the reward will be removed entirely when an arbitrary limit of 21 million bitcoins is reached c. 2140, and record keeping will then be rewarded by transaction fees solely.[45]

Paying a transaction fee is optional, but may speed up confirmation of the transaction.[46] Payers have an incentive to include such fees because doing so means their transaction will likely be added to the block chain sooner; miners can choose which transactions to process[27] and prefer to include those that pay fees. Fees are based on the size of the transaction generated, which in turn is dependent on the number of inputs used to create the transaction. Furthermore, priority is given to older unspent inputs.[47]

Wallets

Electrum bitcoin wallet

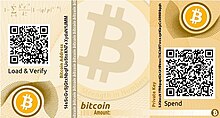

Bitcoin paper wallet generated at bitaddress.org

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold[48] or store bitcoins,[49] due to the nature of the system, bitcoins are inseparable from the block chain transaction ledger. Perhaps a better way to describe a wallet is something that “stores the digital credentials for your bitcoin holdings”[49] and “allows you to access (and spend) them”. Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated.[50] At its most basic, a wallet is a collection of these keys. Software wallets also include the ability to connect to the network and facilitate transactions.

There are several types of wallets. Software wallets connect to the network and allow spending bitcoins in addition to holding the credentials that prove ownership.[51] Internet services called online wallets like Blockchain.info, Circle, or Coinbase offer similar functionality but may be easier to use.[52] Physical wallets also exist and are more secure, as they store the credentials necessary to spend bitcoins offline.[49] One example, ubiquitous in media coverage, combines a novelty coin with these credentials printed on paper, metal,[53] wood,[54] or plastic. Others are simply paper printouts. Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions.[55]

- History

The first wallet program, called Bitcoin-Qt, was released in 2009 by Satoshi Nakamoto as open-source code.[51] It can be used as a desktop wallet for payments or as a server utility for merchants and other payment services. Bitcoin-Qt, also called Satoshi client, is sometimes referred to as the reference client because it serves to define the bitcoin protocol and acts as a standard for other implementations.[51] As of version 0.9, Bitcoin-Qt has been renamed Bitcoin Core to more accurately describe its role in the network.[56]

Privacy

In the bitcoin system, privacy can be defined as not identifying owners of bitcoin addresses. All transaction data is public, and while bitcoin users are identified by bitcoin addresses not names, transactions can be linked to individuals and companies.[57] Additionally, exchanges, where people buy and sell bitcoins for cash, may be required to collect personal information.[58] To maintain financial privacy, a different bitcoin address for each transaction is recommended.[59] Transactions that spend coins from multiple inputs can reveal that the inputs may be linked. Users concerned about privacy can also use so-called mixing services that swap coins they own for coins with different transaction histories.[60]

Comparing privacy levels, it has been suggested that bitcoin payments should not be considered any more private than credit card payments.[61]

Fungibility

Wallets and similar software technically handle bitcoins as equivalent, establishing the basic level of fungibility. Researchers have pointed out that the history of every single bitcoin is registered and publicly available in the block chain ledger, and that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin’s fungibility.[62]

History

Bitcoin was invented by Satoshi Nakamoto,[note 5] who published his invention on 31 October 2008 in a research paper called “Bitcoin: A Peer-to-Peer Electronic Cash system”.[12] It was released in January 2009 as the first decentralized digital currency.[24]:1

One of the first supporters, adopters, contributor to bitcoin and receiver of the first bitcoin transaction was a cryptographer, cypherpunk, futurist and programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world’s first bitcoin transaction.[63][64]

Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.[65]

In 2009, an exploit in an early bitcoin client was found that allowed large numbers of bitcoins to be created.[66]

Based on bitcoin’s open source code, other cryptocurrencies started to emerge in 2011.[25]

In March 2013, a technical glitch caused a fork in the block chain, with one half of the network adding blocks to one version of the chain and the other half adding to another. For six hours two bitcoin networks operated at the same time, each with its own version of the transaction history. The core developers called for a temporary halt to transactions, sparking a sharp sell-off. Normal operation was restored when the majority of the network downgraded to version 0.7 of the bitcoin software.[66]

Some mainstream websites began accepting bitcoins c. 2013. WordPress started in November 2012,[67] followed by OKCupid in April 2013,[68] Atomic Mall in November 2013,[69] TigerDirect[70] and Overstock.com in January 2014,[71] Expedia in June 2014,[72] andNewegg and Dell in July 2014.[73][note 11] Certain non-profit or advocacy groups such as the Electronic Frontier Foundation accept bitcoin donations.[75] (The organization started accepting bitcoins in January 2011,[76] stopped accepting them in June 2011,[77] and began again in May 2013.[75])

The first law enforcement events occurred in May 2013, when assets belonging to the Mt. Gox exchange were seized by Department of Homeland Security.[78] The Silk Road drug market website was shut down by the U.S. Federal Bureau of Investigation (FBI) in October 2013.[79]

In October 2013, Chinese internet giant Baidu had allowed clients of website security services to pay with bitcoins.[80] During November 2013, the China-based bitcoin exchange BTC China overtook the Japan-based Mt. Gox and the Europe-based Bitstamp to become the largest bitcoin trading exchange by trade volume.[81] On 19 November 2013, the value of a bitcoin on the Mt. Gox exchange soared to a peak of US$900 after a United States Senate committee hearing was told by the FBI that virtual currencies are a legitimate financial service.[82] On the same day, one bitcoin traded for over RMB¥6780 (US$1,100) in China.[83] On 5 December 2013, the People’s Bank of China prohibited Chinese financial institutions from using bitcoins.[84] After the announcement, the value of bitcoins dropped,[85] and Baidu no longer accepted bitcoins for certain services.[86] Buying real-world goods with any virtual currency had been illegal in China since at least 2009.[87]

The first bitcoin ATM was installed in October 2013 in Vancouver, British Columbia, Canada.[88]

With roughly 12 million existing bitcoins in November 2013,[89] the new price increased the market cap for bitcoin to at least US$7.2 billion.[90] By 23 November 2013, the total market capitalization of bitcoin exceeded US$10 billion for the first time.[91]

In the United States two men were arrested in January 2014 on charges of money-laundering using bitcoins including Charlie Shrem, the head of defunct bitcoin exchange BitInstant and a vice chairman of the Bitcoin Foundation. Shrem allegedly allowed the other arrested party to purchase large quantities of bitcoins for use on black-market websites.[92]

In early February 2014, one of the largest bitcoin exchanges, Mt. Gox,[93] suspended withdrawals citing technical issues.[94] By the end of the month, Mt. Gox had filed for bankruptcy protection in Japan amid reports that 744,000 bitcoins had been stolen.[95] Originally a site for trading Magic: The Gathering cards,[96] Mt. Gox once was the dominant bitcoin exchange although prior to the collapse its popularity had waned due largely to users having difficulty withdrawing funds.[97]

On June 18, 2014, it was announced that Bitcoin payment service provider BitPay would become the new sponsor of St. Petersburg Bowl under a two-year deal, renamed the Bitcoin St. Petersburg Bowl. Bitcoin will be accepted for ticket and concession sales at the game as part of the sponsorship, and the sponsorship itself was also paid for using Bitcoin.[98]

Etymology

The word bitcoin is a compound of the words “bit” (being itself a compound of the words binary and digit) and “coin” (originally meaning wedge, stamp, corner).[99] The white paper[12] that is the basis of bitcoin frequently uses just the shorter “coin”.

Economics

Classification

According to the director of the Institute for Money, Technology and Financial Inclusion at the University of California-Irvine there is “an unsettled debate about whether bitcoin is a currency or payment protocol”.[100] Bitcoin is commonly referred to with terms like: digital currency,[24]:1 digital cash,[101] virtual currency[4] electronic currency,[16] or cryptocurrency.[100] Its inventor, Satoshi Nakamoto, called bitcoin electronic cash.[12]

In a March 2014 issue, The Economist stated that economists define money as a store of value, a medium of exchange, and a unit of account, and they agree that bitcoin has some way to go to meet all these criteria. It does best as a medium of exchange.[note 12] The bitcoin market currently suffers from volatility, limiting the ability of bitcoin to act as a stable store of value, and retailers accepting bitcoin use other currencies as their principal unit of account.[105]

Various government agencies, departments, and courts have classified bitcoins differently. Both the U.S. Treasury[1] and the European Central Bank[106]:6 classify bitcoin as a convertible decentralized virtual currency. The People’s Bank of China has stated that bitcoin “is fundamentally not a currency but an investment target”.[107] Magistrate Judge Amos L. Mazzant of a Texas court classified bitcoins as a currency.[108] A German court found bitcoin to be a unit of account.[15]:10 The Finnish government judged it to be a commodity.[109]

Journalists and academics likewise dispute what to call bitcoin. Some media outlets do make a distinction between “real” money and bitcoins,[110] while other call bitcoin real money.[111] The Wall Street Journal declared it a commodity in December 2013.[112] A Forbes journalist referred to it as digital collectible.[113] Two University of Amsterdam computer scientists proposed the term “money-like informational commodity” in order “to allow for a systematic discussion of its development through all stages including an initial stage and a possible demise without being constrained by the implications of it being a money or a near-money”.[114]

Buying and selling

Bitcoins can be bought and sold with many different currencies from individuals and companies. Bitcoins may be purchased in person[115] or at a bitcoin ATM in exchange for cash currency.[116] Participants in online exchanges offer bitcoin buy and sell bids. Using an online exchange to obtain bitcoins entails some risk, and, according to a study published in April 2013, 45% of exchanges fail and take client bitcoins with them.[117] Exchanges have since implemented measures to provide proof of reserves in an effort to convey transparency to users.[118] Due to the public visibility of the Blockchain users can personally verify the existence of such funds. Since bitcoin transactions are irreversible, sellers of bitcoins must take extra measures to ensure they have received traditional funds from the buyer.

Price and volatility

Price[note 13] and volatility[note 14]chart.[note 9] Left vertical axis: price, the scale is logarithmic. Right vertical axis: volatility. Horizontal axis: date ranging from 2010-08-17 to 2014-12-31.

To improve access to price information and increase transparency, on 30 April 2014 Bloomberg LP announced plans to list prices from bitcoin companies Kraken and Coinbase on its 320,000 subscription financial data terminals.[119]

According to Mark T. Williams, as of 2014, bitcoin has volatility seven times greater than gold, eight times greater than the S&P 500, and eighteen times greater than the U.S. dollar.[120]

Attempting to explain the high volatility, a group of Japanese scholars states that there is no stabilization mechanism.[121] The Bitcoin Foundation contends that high volatility is due to insufficient liquidity,[122] while a Forbes journalist claims that it is related to the uncertainty of its long-term value,[123] and the high volatility of a startup currency makes sense, “because people are still experimenting with the currency to figure out how useful it is.”[124]

There are uses where volatility does not matter, such as online gambling, tipping, and international remittances.[124] As of 2014, pro-bitcoin venture capitalists argue the greatly increased trading volume that planned high-frequency trading exchanges are hoped to bring, will decrease price volatility.[119] According to Radoslav Albrecht, charts of the past volatility reveal a tendency of bitcoin volatility to decline.[125]

The price of bitcoins has gone through various cycles of appreciation and depreciation referred to by some as bubbles and busts.[126][127] In 2011, the value of one bitcoin rapidly rose from about US$0.30 to US$32 before returning to US$2.[128] In the latter half of 2012 and during the 2012-2013 Cypriot Financial Crisis, the bitcoin price began to rise,[129] reaching a high of US$266 on 10 April 2013, before crashing to around US$50.[130] On November 29, 2013, the cost of one bitcoin rose to the all-time peak of US$1,242.[131] In 2014 the price fell sharply, and as of April remained depressed at little more than half 2013 prices. As of August 2014 it is under US$600.[132] The Washington Post pointed out that the observed cycles of appreciation and depreciation don’t correspond to the definition of speculative bubble.[128]

Speculative bubble dispute

Bitcoin has been labelled a speculative bubble by many including former Fed Chairman Alan Greenspan[133] and economist John Quiggin.[134]

Nobel Laureate Robert Shiller said that bitcoin “exhibited many of the characteristics of a speculative bubble”.[135]

Two lead software developers of bitcoin, Gavin Andresen[136] and Mike Hearn,[137] have warned that bubbles may occur.

David Andolfatto, a Vice President at the Federal Reserve Bank of St. Louis, stated: “Is bitcoin a bubble? Yes, if bubble is defined as a liquidity premium.” According to Andolfatto, most assets likely have a “bubble” component to their price, e.g., gold.[42]:21

Business Insider analyst Matthew Boesler rejects the speculative bubble label and sees bitcoin’s quick rise in price as nothing more than normal economic forces at work.[138]

Ponzi scheme dispute

A 2012 report by the European Central Bank had stated, “it [is not] easy to assess whether or not the bitcoin system actually works like a pyramid or Ponzi scheme.”[106]:27 A 2014 report by the World Bank states: “Contrary to a widely-held opinion, bitcoin is not a deliberate Ponzi”.[139]:7 In the opinion of Eric Posner, a law professor at the University of Chicago “A real Ponzi scheme takes fraud; bitcoin, by contrast, seems more like a collective delusion.”[140] U.S. economist Nouriel Roubini, former senior adviser to the U.S. Treasury and the International Monetary Fund, has stated: “Bitcoin Is A Ponzi Game”.[141] In February 2014 an asset-manager and columnist for The New York Post called bitcoin a Ponzi scheme opining: “Welcome to 21st-century Ponzi scheme: Bitcoin”.[142] The head of theEstonian central bank, Mihkel Nommela stated: “virtual currency schemes are an innovation that deserves some caution, given the lack of … evidence that this isn’t just a Ponzi scheme.”[143] The Huffington Post questioned: “Is Bitcoin a Ponzi scheme, yes or no?”, and answered the question “No!”.[144] The PC World stated: “bitcoin is clearly not a Ponzi scheme”.[145] Economist Jeffrey Tucker published the opinion: “There are several key differences between a Ponzi scheme and bitcoin.”[146] A 2014 report by Federal Council (Switzerland) states: “the question is repeatedly raised whether bitcoin can be deemed an impermissible pyramid scheme… Since in the case of bitcoin the typical promises of profits are lacking, it cannot be assumed that bitcoin is a pyramid scheme.”[147]:21

Value forecasts

Financial journalists and analysts, economists, and investors have attempted to predict the possible future value of bitcoin. In April 2013, economist John Quiggin stated, “bitcoins will attain their true value of zero sooner or later, but it is impossible to say when”.[134] A similar forecast was made in November 2014 by economist Kevin Dowd.[148] In November 2014, David Yermack, Professor of finance at NYU Stern School of Business forecast that in November 2015 bitcoin may be all but worthless.”[149] In December 2013, finance professor Mark T. Williams forecast a bitcoin would be worth less than ten U.S. dollars by July 2014.[150] In the indicated period bitcoin has exchanged as low as $344 (April 2014) and during July 2014 the bitcoin low has been $609.[note 9][151] In December 2014 professor Williams said: “The probability of success is low, but if it does hit, the reward will be very large.”[152] In May 2013, Bank of America FX and Rate Strategist David Woo forecast a maximum fair value per bitcoin of $1,300.[153] Bitcoin investor Cameron Winklevoss stated in December 2013 that the “[s]mall bull case scenario for bitcoin is… 40,000 USD a coin”.[154]

Reception

Some economists have responded positively to bitcoin, but many have not. François R. Velde, Senior Economist at the Chicago Fed described it as “an elegant solution to the problem of creating a digital currency”.[155] According to Wired “in the estimation of many leading economists, bitcoin is a fatally flawed idea shaped by people who don’t really understand how money works”.[156] Paul Krugman and Brad DeLong have found fault with bitcoin questioning why it should act as a reasonably stable store of value or whether there is a floor on its value.[157] Economist John Quiggin has criticized bitcoin as “the final refutation of the efficient-market hypothesis”.[134]

David Andolfatto, Vice President at the Federal Reserve Bank of St. Louis, stated that bitcoin is a threat to the establishment, which he argues is a good thing for the Federal Reserve System and other central banks because it prompts these institutions to operate sound policies.[42]:33[158][159]

Free software movement activist Richard Stallman has criticized the lack of anonymity and called for reformed development.[160] PayPal President David A. Marcus calls bitcoin a “great place to put assets” but claims it will not be a currency until price volatility is reduced.[161] Bill Gates, in relation to the cost of moving money from place to place in an interview for Bloomberg L.P. stated: “Bitcoin is exciting because it shows how cheap it can be.”[162]

Similarly, Peter Schiff, a bitcoin sceptic understands “the value of the technology as a payment platform” and his SchiffGold fund partnered with BitPay in May 2014, because “a wire transfer of fiat funds can be slow and expensive for the customer”.[163]Schiff sees bitcoin more as a payment method rather than a currency.

Kevin Dowd, professor of finance and economics at Durham University has a bearish outlook on bitcoin as a currency. At the Cato Institute’s 2014 Annual Conference with the topic ‘Alternatives to Central Banking: Toward Free-Market Money’[164] he said “bitcoin’s current incentive structure [is] leading to an inevitable collapse, mostly due to the centralization of mining”.[165]

Acceptance by merchants

Bitcoins are accepted in this café in the Netherlands as of 2013

As of August 2014 established firms that accept payments in bitcoin include Atomic Mall,[69] Clearly Canadian,[166] Dell,[167] Dish Network, Expedia,[168] Newegg,[169] PrivateFly,[170] Overstock.com,[71] the Sacramento Kings,[171]TigerDirect,[70] Virgin Galactic,[172] and Zynga.[173][note 11]

Due to the fact that chargebacks are impossible, retailers usually offer in-store credit as the only option when returning items purchased with bitcoins.[174]

In late 2013 the University of Nicosia became the first university in the world to accept bitcoins.[175]

In January 2014 porn.com announced that a quarter of its sales were via bitcoin.[176]

As of 30 July 2014 the Wikimedia Foundation, hoster of Wikipedia, offers the possibility of making donations to it in bitcoin (through Coinbase) on their donations page.[177] As of 22 September 2014 Greenpeace offers the possibility of making donations to it in bitcoin (through Bitpay).[178] As of 20 November 2014 the Mozilla Foundation accepts bitcoin donations via Coinbase.[179]

As of 23 September 2014 PayPal offers its North American merchants the possibility to receive customer payments for digital goods in bitcoin.[180]

As of 11 December 2014, Microsoft accepts bitcoin from U.S. customers to fund a Microsoft Account, which can be used to digitally purchase XBox content and Windows apps.[181]

As of 16 December 2014, Time Inc. announced that consumers can now use bitcoin to buy subscriptions of its magazines.[182]

On January 5, 2015 Bacchus Entertainment, a niche fetish pornography website, purportedly became the first porn membership website to accept only bitcoin, thus circumventing the strictures of credit card payment mechanisms.[183]

Financial institutions

Bitcoin companies have had difficulty opening traditional bank accounts because lenders have been leery of bitcoin’s links to illicit activity.[184] According to Antonio Gallippi, a co-founder of BitPay, “banks are scared to deal with bitcoin companies, even if they really want to”.[185] Some financial institutions have been bullish on bitcoin. In a 2013 report, Bank of America Merrill Lynch stated that “we believe bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers. As a medium of exchange, bitcoin has clear potential for growth and that in a long-term fair-value analysis maximum market capitalization for bitcoins could be $15 billion”.[186] In June 2014, the first bank that converts deposits in currencies instantly to bitcoin without any fees, for further transactions, was opened in Boston.[187]

Concurrent with Bloomberg LP, 33% owned by Merrill Lynch launching pricing information is the development of high-frequency trading firms by Atlas ATS in New York and Hong Kong and one from London-based Coinfloor, claiming to be the first auditable bitcoin exchange, and a SecondMarket project of an exchange for institutional investors.[119]

According to David Andolfatto, a Vice President at the Federal Reserve Bank of St. Louis, bitcoin “Will force traditional institutions to adapt or die.”[42]:33

Mining pools

Obsolete bitcoin mining hardware called ASICMiner Block Erupter USB common in mid and late 2013.[note 15]

As of 2013 mining had become quite competitive, has been compared to an arms race and ever more specialized technology is utilized. The most efficient mining hardware makes use of custom designed application-specific integrated circuits, which outperform general purpose CPUs and use less power as well.[192] Without access to these purpose built machines, a bitcoin miner is unlikely to earn enough to even cover the cost of the electricity used in his or her efforts.[193]

The individual odds of winning the reward for adding a block to the block chain decrease with an increasing number of miners. As of 2014, it has become common for miners to join organized mining pools.[194] A pool splits the work between its members and has a much larger chance to win the reward. The reward is then split between the members creating a steady stream of income.[195] Even for those who join pools, the cost of the electricity necessary to mine may outweigh the rewards from doing so.[193]

As investment

One way of investing in bitcoins is to buy and hold them as a long-term investment.[196] The Financial Industry Regulatory Authority (FINRA), a United States self-regulatory organization,[197] and the European Banking Authority[29]warned that investing in bitcoins carries significant risks. Risk hasn’t deterred some such as the Winklevoss twins, who in April 2013 claimed they owned nearly 1% of all bitcoins in existence at the time[198] and have since attempted to launch a bitcoin ETF.[31] The first regulated bitcoin fund was established in Jersey in July 2014, with the approval of the Jersey Financial Services Commission.[199] Other investors, like Peter Thiel’s Founders Fund, which invested US$3 million in BitPay, do not purchase bitcoins themselves, instead funding bitcoin infrastructure like companies that provide payment systems to merchants, exchanges, wallet services, etc.[200] In 2012, an incubator for bitcoin-focused start-ups was founded by Adam Draper with financing help from his father, venture capitalist Tim Draper, one of the largest bitcoin holders after winning an auction of 30,000 bitcoins,[201] at the time called ‘mystery buyer’.[202] The company’s goal is to fund 100 bitcoin businesses within 2–3 years with $10,000 to $20,000 for a 6% stake.[201] Investors also invest in bitcoin mining.[203]

Hedge against financial crises

Bitcoins have been used by some Argentinians to protect their savings against high inflation or the possibility that governments could confiscate savings accounts[58] because the Argentine peso[204] is stymied by inflation and strict capital controls. During the 2012–2013 Cypriot financial crisis, bitcoin purchases rose due to fears that savings accounts would be confiscated or taxed.[205]

Political economy

Bitcoin appeals to tech-savvy libertarians, because it so far exists outside the institutional banking system and the control of governments.[206] Its appeal reaches from left wing critics, “who perceive the state and banking sector as representing the same elite interests, […] recognising in it the potential for collective direct democratic governance of currency”[207] and socialists proposing their “own states, complete with currencies”,[208] to right wing critics suspicious of big government, at a time when activities within the regulated banking system were responsible for the severity of the financial crisis of 2007–08,[209] “because governments are not fully living up to the responsibility that comes with state-sponsored money”.[210] Bitcoin has been described as “remov[ing] the imbalance between the big boys of finance and the disenfranchised little man, potentially allowing early adopters to negotiate favourable rates on exchanges and transfers – something that only the very biggest firms have traditionally enjoyed”.[211]

Legal status and regulation

Few governments have moved to regulate bitcoin and similar private currencies. According to the European Central Bank, traditional financial sector regulation is not applicable because bitcoin does not involve traditional financial actors.[106]:5 Under other regimes, existing rules have been extended to include bitcoin and bitcoin companies. As of 2014, Bitcoin is illegal only in two countries: Vietnam, where trading in Bitcoin and “other electronic currencies” is against the law and not allowed, and Iceland, whose central bank throttles incoming bitcoins to restrict money flow abroad.[212] The flourishing bitcoin mining business in Iceland[213] is not affected by this rule.[214] Steven Strauss, a Harvard public policy professor, suggested in April 2013 that governments could outlaw bitcoin,[215] a possibility that was mentioned in a 2013 U.S. Securities and Exchange Commission (SEC) filing made by a bitcoin investment vehicle.[31] A survey of forty foreign jurisdictions and the European Union is maintained by the U.S. Library of Congress.[15]

China

On 5 December 2013, China Central Bank made its first step in regulating bitcoin by prohibiting financial institutions to handle bitcoin transactions.[216] In a statement on the central bank’s website the People’s Bank of China said financial institutions and payment companies cannot give pricing in, buy and sell bitcoin or insure bitcoin-linked products. A December 2013 statement from BTC China suggested payment processors had voluntarily withdrawn their services.[217] On 1 April 2014 China Central Bank ordered commercial banks and payment companies to close bitcoin trading accounts in two weeks.[218] Trading bitcoins by individuals is legal in China.[216]

European Union

In July 2014 the European Banking Authority advised European banks not to deal in virtual currencies such as bitcoin until a regulatory regime was in place.[219]

G7

The 2013 G7’s Financial Action Task Force published guidance for Internet-based payment services that defines “exchangers buying or selling digital currency for cash (or other digital currencies) […] as a virtual bureau de change” and warns that “Internet-based payment services that allow third party funding from anonymous sources may face an increased risk of [money laundering/terrorist financing]” concluding that this may “pose challenges to countries in [anti-money laundering/counter terrorist financing] regulation and supervision”.[220]

United States

The U.S. Government Accountability Office (GAO) reviewed virtual currencies upon the request of the Senate Finance Committee and in May 2013 recommended[221] that the Internal Revenue Service (IRS) formulate tax guidance for bitcoin businesses. On 25 March 2014, in time for 2013 tax filing, the IRS issued a guidance that virtual currency is treated as property for U.S. federal tax purposes and that “an individual who ‘mines’ virtual currency as a trade or business [is] subject to self-employment tax”.[222]

A June 2014 U.S. government auction of almost 30,000 bitcoins, which the U.S. Marshals Service seized in October 2013 from Silk Road, was said to increase legitimacy of the currency. The 45 registered bidders, each of whom put down a deposit of $200,000 made 63 bids.[202]

On 18 November 2013, the United States Senate held a committee hearing titled “Beyond Silk Road: Potential Risks, Threats and Promises of Virtual Currencies” to discuss virtual currencies.[223] At this hearing, held by senator Tom Carper, bitcoin and other currencies were received generally positively, with it being stated that bitcoin was a “legal means of exchange” and that “online payment systems, both centralized and decentralized, offer legitimate financial services” by US officials such as Peter Kadzik and Mythili Raman.[89][224]

The Federal Election Commission (FEC) deadlocked on Nov 21, 2013 on whether to allow bitcoin in political campaigns.[225] Their decision was split across party lines (three members Democrat voting nay, three Republicans voting yea). While their decision covered group donations, political bitcoin pioneers New Hampshire House member Mark Warden[226] and Southern California politician Michael B. Glenn[227] acted independently in accepting bitcoin, and paved the way for others to follow suit. In October, Former SEC Chair Arthur Levitt joined BitPay, a bitcoin payment processor, and Vaurum, a bitcoin exchange for institutional investors in advisory roles.[228]

In January 2014, the U.S. Securities and Exchange Commission (SEC) was focused on whether bitcoin-denominated stock exchanges were illegal, per its enforcement administrator, and inquired into the gambling site SatoshiDice listing shares on bitcoin exchange MPEx.[229] In May it warned investors that “both fraudsters and promoters of high-risk investment schemes may target bitcoin users”.[230] The SEC charged and settled with the former owner of SatoshiDice in June 2014 for selling securities without registering with the SEC.[231]

The U.S. Commodity Futures Trading Commission stated in March 2014 it was considering regulation of digital currencies.[232]

On 8 May 2014, the U.S. Federal Election Commission issued draft guidance to U.S. politicians who want to receive bitcoin donations.[233] The Commission declined to declare bitcoins currency, stating they fit into its “anything of value” definition.[234] Also that month, Brett Stapper, co-founder of Falcon Global Capital, registered to lobby members of Congress and federal agencies on issues related to bitcoin.[235]

In June 2014 California Assemblyman Roger Dickinson (D–Sacramento) submitted draft legislation (Assembly Bill 129) to legalize bitcoin and all other forms of alternative and digital currency.[236] After the GAO had called for increased oversight of bitcoin, the Consumer Financial Protection Bureau warned consumers of bitcoin being risky.[237]

As of November 2014, there are no final rules at the U.S. state level yet. In March, the New York State Department of Financial Services led by superintendent Benjamin Lawsky had officially invited bitcoin exchanges to apply with them,[238] and on 17 July it published draft regulations for virtual currency businesses.[239] Businesses would have to provide transaction receipts, disclosures about risks, policies to handle customer complaints, maintain a cybersecurity program, hire a compliance officer and verify details about their customers to follow anti-money-laundering rules, per FinCEN.[239]

Criminal activity

The appeal of bitcoin to criminals has attracted the attention of financial regulators, legislative bodies, law enforcement, and the media.[240] The FBI prepared an intelligence assessment,[241] the SEC has issued a pointed warning about investment schemes using virtual currencies,[240] the U.S. Senate held a hearing on virtual currencies in November 2013, CNN has referred to bitcoin as a “shady online currency [that is] starting to gain legitimacy in certain parts of the world”,[242] and The Washington Post called it “the currency of choice for seedy online activities”.[243] Criminal activity involving bitcoin has centered around theft, and the use of bitcoins in exchange for illegal items or services.

Theft

There have been many cases of bitcoin theft.[50] The non-profit Bitcoin Foundation maintains that “cryptography is the reason no one can steal bitcoins.”[244] However, bitcoins may be spent by anyone with access to the corresponding private key, authorized or not.

One way theft is accomplished involves a thief infiltrating the private keys of the victim’s bitcoin address,[245] or of an online wallet.[246] If the private key is stolen, the thief can use it to transfer all the bitcoins from the compromised address to another address of his own. In that case, the network does not have any provision to identify the thief, to block further transactions of those stolen bitcoins, or return them to the legitimate owner.[31][247]

Many high-profile thefts have been reported. In late November 2013, an estimated $100 million in bitcoins were stolen from the online illicit goods marketplace Sheep Marketplace, which immediately closed.[248] Users tracked the coins as they were processed and converted to cash, but no funds were recovered and no culprits identified.[248] A different black market, Silk Road 2, stated that during a February 2014 hack, bitcoins valued at $2.7 million were taken from escrow accounts.[249] Inputs.io, an Australian bitcoin wallet service was hacked twice in October 2013 and lost more than $1 million in bitcoins.[250] In late February 2014 Mt. Gox, one of the largest virtual currency exchanges, filed for bankruptcy in Tokyo amid reports that 744,000 bitcoins had been stolen.[95] Flexcoin, a bitcoin storage specialist based in Alberta, Canada, shut down on March 2014 after saying it discovered a theft of about $650,000 in bitcoins.[251] Poloniex, a digital currency exchange, reported on March 2014 that it lost bitcoins valued at around $50,000.[252] Beginning of January 2015, UK based bitstamp, the third busiest bitcoin exchange globally was hacked, and 19,000 bitcoins ($5 million) were stolen.[253]

Black markets

Because of their presumed capacity to obfuscate the source of payments in online transactions and bypass money transfer controls by governments and law enforcement agencies, bitcoin have come to be used in the deep web black markets.[254] In 2012, it was estimated that 4.5% to 9% of all transactions of all bitcoin exchanges in the world were for drug trades on a single deep web drugs market, Silk Road.[255] The bulk of bitcoin purchases during the time were speculative in nature,[255] so drugs must have constituted a greater percentage of the actual goods purchased with bitcoins c. 2012.[according to whom?]

Several deep web black markets have been shut by authorities. In October 2013 Silk Road was shut down by U.S. law enforcement[254][256][257] leading to a short-term decrease in the value of bitcoin.[258] Alternative sites were soon available, and in early 2014 theAustralian Broadcasting Corporation reported that the closure of Silk Road had little impact on the number of Australians selling drugs online, which had actually increased.[259] In early 2014, Dutch authorities closed Utopia, an online illegal goods market, and seized 900 bitcoins.[260] In late 2014, a joint police operation saw European and American authorities seize bitcoins and close 400 deep web sites including the illicit goods market Silk Road 2.0.[261]

On 19 December 2014 Charlie Shrem was sentenced to two years in prison for indirectly helping to send $1 million to Silk Road.[262]

Several news outlets have asserted that the popularity of bitcoins hinges on the ability to use them to purchase illegal goods.[33][263] Non-drug transactions were thought to be far less than the number involved in the purchase of drugs,[264] and roughly one half of all transactions made using bitcoin c. 2013 were bets placed at a single online gambling website, Satoshi Dice.[265] One source stated online gun dealers use bitcoin to sell arms without background checks.[266]

Some black market sites may seek to steal bitcoins from customers. The bitcoin community branded one site, Sheep Marketplace, as a scam when it prevented withdrawals and shut down after an alleged bitcoins theft.[267] In a separate case, escrow accounts with bitcoins belonging to patrons of a different black market were hacked in early 2014.[249]

Money laundering

Bitcoins may not be ideal for money laundering because all transactions are public.[268] Authorities, including the European Banking Authority[29] and the FBI[241] have expressed concerns that bitcoin may be used for money laundering. In early 2014, an operator of a U.S. bitcoin exchange was arrested for money laundering.[92]

Ponzi scheme using bitcoins

In a Ponzi scheme that utilized bitcoins, The Bitcoin Savings and Trust promised investors up to 7 percent weekly interest, and raised at least 700,000 bitcoins from 2011 to 2012.[269] In July 2013 the U.S. Securities and Exchange Commission charged the company and its founder in 2013 “with defrauding investors in a Ponzi scheme involving bitcoin”.[269] In September 2014 the judge fined Bitcoin Savings & Trust and its owner $40 million for operating a bitcoin Ponzi scheme.[270]

Malware

Bitcoin-related malware includes software that steals bitcoins from users using a variety of techniques, software that uses infected computers to mine bitcoins, and different types of ransomware, which disable computers or prevent files from being accessed until some payment is made. Security company Dell SecureWorks said in February 2014 that it had identified 146 types of bitcoin malware; about half of it undetectable with standard antivirus scanners.[271]

In June 2011, Symantec warned about the possibility that botnets could mine covertly for bitcoins.[272] Malware used the parallel processing capabilities of GPUs built into many modern video cards.[273] Although the average PC with an integrated graphics processor is virtually useless for bitcoin mining, tens of thousands of PCs laden with mining malware could produce some results.[274]

In mid-August 2011, bitcoin mining botnets were detected,[275] and less than three months later, bitcoin mining trojans had infected Mac OS X.[276]

In April 2013, electronic sports organization E-Sports Entertainment was accused of hijacking 14,000 computers to mine bitcoins; the company later settled the case with the State of New Jersey.[277]

German police arrested two people in December 2013 who customized existing botnet software to perform bitcoin mining, which police said had been used to mine at least $950,000 worth of bitcoins.[278]

For four days in December 2013 and January 2014, Yahoo! Europe hosted an ad containing bitcoin mining malware that infected an estimated two million computers.[274] The software, called Sefnit, was first detected in mid-2013 and has been bundled with many software packages. Microsoft has been removing the malware through its Microsoft Security Essentials and other security software since January 2014.[279]

Several reports of employees or students using university or research computers to mine bitcoins have been published.[280][281]

Malware stealing bitcoins

Some malware can steal private keys for bitcoin wallets allowing the bitcoins themselves to be stolen. The most common type searches computers for cryptocurrency wallets to upload to a remote server where they can be cracked and their coins stolen.[271] Many of these also log keystrokes to record passwords, often avoiding the need to crack the keys.[271] A different approach detects when a bitcoin address is copied to a clipboard and quickly replaces it with a different address, tricking people into sending bitcoins to the wrong address.[271] This method is effective because bitcoin transactions are irreversible.

One virus, spread through the Pony botnet, was reported in February 2014 to have stolen up to $220,000 in cryptocurrencies including 335 bitcoins from 85 wallets.[282] Security company Trustwave, which tracked the malware, reports that its latest version was able to steal 30 types of digital currency.[283]

A type Mac malware active in August 2013, Bitvanity posed as a vanity wallet address generator and stole addresses and private keys from other bitcoin client software.[284] A different trojan for Mac OS X, called CoinThief was reported in February 2014 to be responsible for multiple bitcoin thefts, including one user who lost 20 bitcoins.[284] The software was hidden in versions of some cryptocurrency apps on Download.com and MacUpdate.[284]

Ransomware

Another type of bitcoin-related malware is ransomware. One program called Cryptolocker, typically spread through legitimate-looking email attachments, encrypts the hard drive of an infected computer, then displays a countdown timer and demands a ransom, usually two bitcoins, to decrypt it.[285] Massachusetts police said they paid a 2 bitcoin ransom in November 2013, worth more than $1,300 at the time, to decrypt one of their hard drives.[286] Linkup, a combination ransomware and bitcoin mining program that surfaced in February 2014, disables internet access and demands credit card information to restore it, while secretly mining bitcoins.[285]

Security

Various potential attacks on the bitcoin network and its use as a payment system, real or theoretical, have been considered. The bitcoin protocol includes several features that protect it against some of those attacks, such as unauthorized spending, double spending, forging bitcoins, and tampering with the block chain.[43] Other attacks, such as theft of private keys, require due care by users.

Unauthorized spending is mitigated by Bitcoin’s implementation of public-private key cryptography. When Alice sends a bitcoin to Bob, Bob becomes the new owner of the bitcoin. Eve observing the transaction might want to spend the bitcoin Bob just received, but she cannot sign the transaction without the knowledge of Bob’s private key.[24]

Double spending

A specific problem that an internet payment system must solve is double-spending, whereby a user pays the same coin to two or more different recipients. An example of such a problem would be if Eve sent a bitcoin to Alice and later sent the same bitcoin to Bob. The bitcoin network guards against double-spending by recording all bitcoin transfers in a ledger (the block chain) that is visible to all users, and ensuring for all transferred bitcoins that they haven’t been previously spent.[24]:4

Race attack

If Eve offers to pay Alice a bitcoin in exchange for goods and signs a corresponding transaction, it is still possible that she also creates a different transaction at the same time sending the same bitcoin to Bob. By the rules, the network accepts only one of the transactions. This is called race attack, since there is a race which transaction will be accepted first. Alice can reduce the risk of race attack stipulating that she will not deliver the goods until Eve’s payment to Alice appears in the block chain.[287]

A variant race attack (which has been called a Finney attack by reference to Hal Finney) requires the participation of a miner. Instead of sending both payment requests (to pay Bob and Alice with the same coins) to the network, Eve issues only Alice’s payment request to the network, while the accomplice tries to mine a block that includes the payment to Bob instead of Alice. There is a positive probability that the rogue miner will succeed before the network, in which case the payment to Alice will be rejected. As with the plain double-spending attack, Alice can reduce the risk of a Finney attack by waiting for the payment to be included in the block chain.[288]

History modification

The other principal way to steal bitcoins would be to modify block chain ledger entries.

For example, Eve could buy something from Alice, like a sofa, by adding a signed entry to the block chain ledger equivalent to Eve pays Alice 100 bitcoins. Later, after receiving the sofa, Eve could modify that block chain ledger entry to read instead: Eve pays Alice 1 bitcoin, or replace Alice’s address by another of Eve’s addresses. Digital signatures cannot prevent this attack: Eve can simply sign her entry again after modifying it.

To prevent modification attacks, each block of transactions that is added to the block chain includes a cryptographic hash code that is computed from the hash of the previous block as well as all the information in the block itself. When the bitcoin software notices two competing block chains, it will automatically assume that the longer one is the valid one. Therefore, in order to modify an already recorded transaction (as in the above example), the attacker would have to recalculate not just the modified block, but all the blocks after the modified one, until the modified chain is longer than the legitimate chain that the rest of the network has been building in the meantime. Consequently, for this attack to succeed, the attacker must outperform the honest part of the network.[43]

Each block that is added to the block chain, starting with the block containing a given transaction, is called a confirmation of that transaction. Ideally, merchants and services that receive payment in bitcoin should wait for at least one confirmation to be distributed over the network, before assuming that the payment was done. The more confirmations that the merchant waits for, the more difficult it is for an attacker to successfully reverse the transaction in a block chain—unless the attacker controls more than half the total network power, in which case it is called a 51% attack.[289] For example, if the attacker possesses 10% of the calculation power of the bitcoin network and the shop requires 6 confirmations for a successful transaction, the probability of success of such an attack will be 0.02428%.[12]

Selfish mining

This attack was first introduced by Ittay Eyal and Emin Gun Sirer at the beginning of November 2013.[290] The attacker does not normally broadcast the blocks upon finding them. He mines his private chain and eventually (when somebody finds his own block) publishes several blocks at row. This makes the “honest” network abandon their last work and switch to the attacker’s branch. As a result, honest miners lose a significant part of their revenue, whilst the attacker increases profits due to changes in relative hashpowers.

According to the authors it changes the incentives for rational miners and makes them want to join the attacker’s pool, increasing attacker’s hashpower (which could potentially lead to 51% attack).

However, other researchers disagree with the conclusion and point out the flaws in the article.[291]

Deanonymisation of clients

Along with transaction graph analysis, which may reveal connections between Bitcoin addresses (pseudonyms),[2][292] there is a possible attack[293] which links user pseudonym to its IP address, even if the peer is using Tor. The attack makes use of Bitcoin mechanisms of relaying peer addresses and anti-DoS protection. The cost of the attack on the full Bitcoin network is under €1500 per month.[293]

In the media

A bitcoin documentary film called The Rise and Rise of Bitcoin made its debut at the Tribeca Film Festival in New York on 23 April 2014, chronicling its origins to its explosive growth in 2013.[294]

Several lighthearted songs celebrating Bitcoin have been released.[295][296][297] Numerous U.S. comedians have made fun of “bitcoin confusion”.[298]

In Fall 2014, undergraduate students at the Massachusetts Institute of Technology (MIT) each received bitcoins worth $100 “to better understand this emerging technology”. One student had the idea of a Bitcoin Club and raised more than half a million dollars from an MIT alumnus working in high-frequency trading.[299]

Some U.S. political candidates, including New York City Democratic Congressional candidate Jeff Kurzon have said they would accept campaign donations in bitcoin.[300]

On September 17, 2014, Dynamite Entertainment became the first comic book publisher to accept bitcoin for purchases through their DRM-Free Digital Comic Store.

source: wikipedia

Click on the bitcoin logo below to buy, use or accept bitcoin. Unocoin is India’s most popular bitcoin wallet.

To read the bitcoin white paper, visit: https://bitcoin.org/bitcoin.pdf