“Bitcoin is the currency of the Internet: a distributed, worldwide, decentralized digital currency. Unlike traditional currencies such as dollars, bitcoins are issued and managed without any central authority whatsoever: there is no government, company, or bank in charge of Bitcoin. As such, it is more resistant to wild inflation and corrupt banks.”

We are now in the ninth year of Bitcoin, the first coins (or “Genesis Block”) having been mined (that is, awarded for solving a computational problem) on January 3, 2009. Yet, Bitcoin has clearly failed to meet the grandiose aims of its advocates. Unlike conventional money, it is not widely used as a means of exchange. And, despite claims that its independence of government would make it a stable store of value, it remains anything but. Instead, the evidence we can find hints that its primary use is to evade capital controls (or, possibly, as an alternative store of value in a repressed financial system). The greatest achievement associated with Bitcoin is not the currency itself, but the blockchain—the distributed ledger technology underlying it—that is now being widely explored in the hopes of slashing costs and improving services in finance and a range of other activities

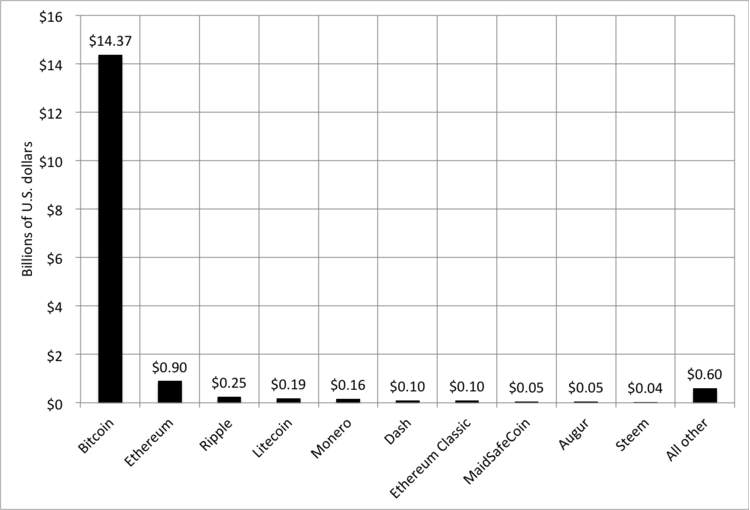

Bitcoin ushered in the era of private digital currencies, also called cryptocurrencies. Today, there are more than 500 “active” examples with a total market value of $16.8 billion (see here). Of these, Bitcoin remains #1, accounting for about 85% of the market (see chart). The advent of hundreds of private entrants into digital coinage should come as no surprise: seignorage (the goods and services that one receives for issuing a widely-accepted medium of exchange) makes currency creation—money printing — a very profitable business.

That Bitcoin would come out on top amid so much competition was not predictable from the early dynamics of the market (see, for example, Gandal and Halaburda). Indeed, digital currency enthusiasts still frequently promote competitors with what may in fact be more attractive features (such as better encryption to ensure anonymity). Nevertheless, at least for now, Bitcoin appears to have benefited from the “winner-take-all” effect that is so common to networks where the more people who use something, the more valuable it is to those who do.

Top 10 digital currencies ranked by market capitalization (Billions of U.S. dollars), 19 January 2017

But how big a winner is Bitcoin? Not very! None of these digital currencies are used much, either individually or collectively. Over the 30 days ending January 19, trading volume in all cryptocurrencies totaled only a very modest $7 billion, of which Bitcoin accounted for 77 percent (source: coinmarketcap.com). For comparison, monthly noncash payments in the United States averaged $14.8 trillion in 2015, according to the Federal Reserve’s latest payments study. Similarly, in the euro area, monthly credit transfers and direct debits in 2015 averaged €11.9 trillion (see table 9.1 here).

That said, who is using Bitcoin? According to bitcoinity.org (see here), the bulk of the activity has been increasingly concentrated so that by 2016, fully 97% of Bitcoin transactions were in China. Most of these took place on three platforms: OKCoin, Huobi, and BTCChina. This geographic concentration is a relatively recent phenomenon: in 2012, the China share of volume was only 1 percent (see chart). Since late 2015, this pattern of increased geographic concentration also has been associated with a pickup in overall transactions—again, in China. (As a result of China’s cheap electricity—a critical input for solving the computing problems necessary to “produce” a Bitcoin—China also reportedly accounts for roughly 70 percent of Bitcoin mining.)

As a result, it seems fair to conclude that the marginal buyers and sellers of Bitcoin are currently Chinese. That judgment is buttressed by at least two additional factors. First, the rise in volume that began in latter half of 2015 follows the bust in China’s stock market, pointing to Bitcoin as an alternative store of value. It also has been roughly coincident with the surge in capital outflows from China. Bitcoin anonymity is of natural value for those who wish to evade capital controls.

Second, the dollar price of a Bitcoin has been very sensitive to recent developments in China. As the chart below indicates, the trend price increase that began in the latter part of 2015 paralleled the devaluation of China’s currency (the yuan), as well as the pickup in Bitcoin trading volume and the capital outflows previously mentioned. To see what we mean, consider the following example. In early January, the price of Bitcoin rose above $1,000. At roughly the same time, on January 3, 2016, the People’s Bank of China (PBoC) tightened monetary conditions, driving the yuan sharply higher versus the dollar (the largest two-day percentage gain since 2005) to counter speculators anticipating a one-way bet. Two days later, on January 5, the PBOC—which had been ratcheting up capital controls for more than year—warned publicly about risks in Bitcoin. As this was happening, the price of a Bitcoin plummeted, falling to $898 by January 6. Then, on January 11, following the announcement that the PBoC would inspect Bitcoin trading platforms in China, the price plunged again. Last week, that probe reportedly led to a halt in leveraged trading of Bitcoin, as well as pressures to comply with anti-money-laundering rules.

Two examples in Latin America provide additional evidence supporting the view that Bitcoin is primarily a means to evade capital controls. While naturally far smaller in volume, following the November 2015 election of a government that quickly relaxed cross-border currency controls, use of Bitcoin in Argentina fell sharply and is now roughly half its peak. In contrast, use in Venezuela (where rapid inflation, combined with capital controls, sustains the incentive for capital flight) rose last summer and has stayed far above year-ago levels.

Not surprisingly, these observations reinforce our longstanding doubts about claims that private digital currencies would somehow supplant government fiat money. It makes sense for governments to explore the possibilities of issuing their own digital currencies, as the Bank of Canada and the Bank of England have been doing for some time. Technological advances that diminish use of cash in several Nordic economies are, willy-nilly, transforming their national currencies into digital ones. And we will not be surprised if the blockchain technology substantially alters the infrastructure of the financial system—clearing, settlement, custody and the like.

But a currency is a public good with network effects: the more widely it is used, the more useful it is. And, in a country that has maintained price stability, there is no reason for the public to give up the enormous benefits that come both from the seignorage revenue they obtain and from the safety provided by a means of payment whose value is guarded by a vigilant government.

Source: http://www.moneyandbanking.com/commentary/2017/1/22/what-bitcoin-has-become